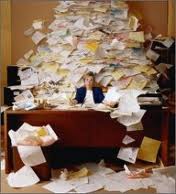

Do you have CHAOS (Can’t Have Anyone Over Syndrome) in your home? VCE Agent Jennifer Abel visited Alexandria’s West End Wellness Center today to share with 40 participants how to reduce clutter in their lives.

Do you have CHAOS (Can’t Have Anyone Over Syndrome) in your home? VCE Agent Jennifer Abel visited Alexandria’s West End Wellness Center today to share with 40 participants how to reduce clutter in their lives.

Clutter can lead to mental anguish, physical hazards (potential for fires, tripping, etc.), and even health issues like allergies or headaches, according to the American Board of Behavioral Psychology. An issue of Mother Jones found that we spend 55 minutes a day looking for things we know we own but can’t find. We can’t even fit all of our belongings in our home; the demand for self-storage has skyrocketed in the last decade. Financial strain is also common, not just because you’re paying for extra storage, but because you incur late charges when you can’t find that bill that’s overdue, or you’re eating out more because it’s just easier than cleaning the kitchen.

So what should you do? Jennifer shared some tips we can all use at home:

1. Get real – Don’t assume you can clear up your clutter in one day. Take manageable steps by tackling one room at a time. Gather five containers: one for trash, one for recyclables, one for donations, one for items to sell, and a laundry basket for things you plan to keep that need to be returned to their proper homes. Then set a timer, and work solely on decluttering and filling these containers until that timer goes off.

2. Ask questions – When you pick up an item, ask yourself a few questions:

- How long has it been since I used this?

- Do I like it?

- Does it work properly? Is it broken?

- Do I have more of this kind of thing? How many do I need?

- If I keep this, what will I get rid of to make room for it?

- (For paper clutter, in particular) Can I locate this information somewhere else (probably on the internet) if I need it?

- 3. Get FAT – No, we’re not suggesting you pack on the pounds. To reduce paper clutter, professional organizer Barbara Hemphill suggests using the F-A-T system, where you pick up a piece of paper and decide immediately whether you will File it, Act on it, or Toss it.

4. Reduce what you bring in to your home – The most efficient way to reduce clutter is to not even bring it in your house. Here are a few ways to do this:

- Reduce the number of financial statements by using only one or two credit cards and consolidate multiple financial accounts to a single financial institution.

- Call 888-5OPTOUT (567-8688) to stop receiving pre-approved credit card offers.

- You can go to http://www.catalogchoice.org/ to get off specific catalog lists.

- Whenever you sign up for anything where you are providing your address, phone number, or email address (how can you resist a drawing for a free car?!?), look for boxes that let you “opt out” of receiving mailings from that company or from others.

- Contact the Direct Marketing Association’s Mail Preference Service to remove your name from mailing lists: https://www.dmachoice.org/.

Finally, celebrate success. The best way to keep your good habits going is to acknowledge and enjoy your progress. (You’ll have plenty of time for this when you’re no longer sifting through enormous piles of clutter!) If you would like to arrange a Controlling Clutter class for a group in your area (in Arlington or Alexandria), please contact Jennifer Abel at jabel@vt.edu or 703-228-6417.

Do you have any good tips to address clutter in your life? Please share your ideas!