Learn the basics of home food preservation, with a hands-on waterbath canning workshop and a pressure canning demonstration. This workshop is perfect for beginners and those looking to brush up on their skills.

Monthly Archives: August 2013

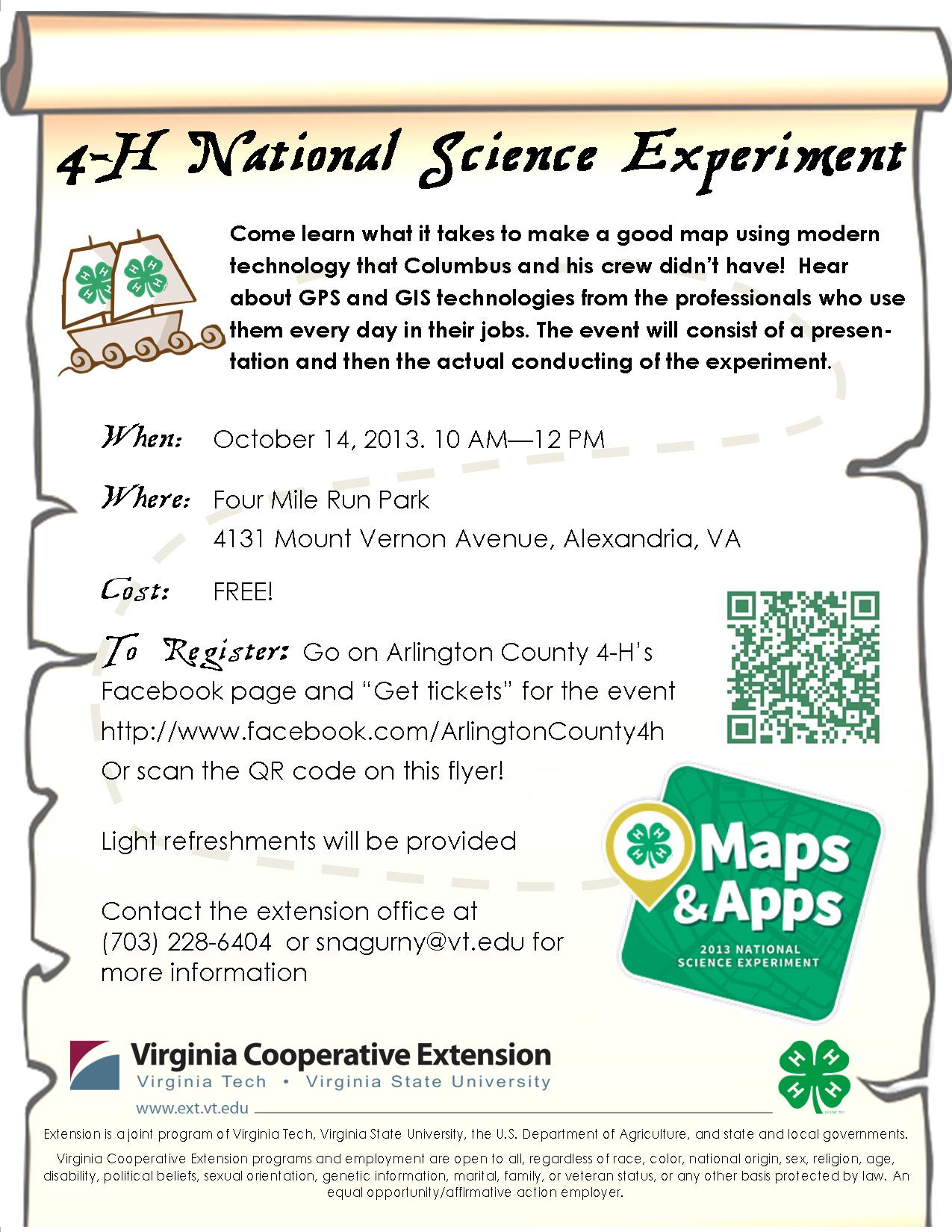

4-H National Youth Science Experiment!

We will be hosting a local National 4-H Youth Science Experiment Event! Every year National 4-H Council presents a national science experiment. In the past these experiments have dealt with a variety of topics like robotics, wind power, and even biofuel. This year’s experiment is entitled “Maps and Apps” and is all about GPS and GIS technologies and solving problems using techniques associated with them. The best part is, you don’t even have to know what that is to be able to complete this experiment! Come learn what it takes to make a good map using modern technology that Columbus and his crew didn’t have! Hear about GPS and GIS technologies from the professionals who use them every day in their jobs. The event will consist of a presentation and then the actual conducting of the experiment.

Our event will be held on October 14th, from 10 AM – 12 PM at Four Mile Run Park’s old Duron Building. 4131 Mount Vernon Avenue, Alexandria, VA. There is no cost, and light refreshments will be provided.

See the flyer or the event page on the Arlington County 4-H facebook at www.facebook.com/ArlingtonCounty4H

You can register for this event by filling out this registration form!

More about the actual experiment itself can be found on the National 4-H Website at 4-h.org

Don’t hesitate to contact the extension office if you have any questions or would like additional information. snagurny@vt.edu or (703) 228-6404

Master Food Volunteers at the Arlington County Fair

The Arlington County Fair took place on August 9-11 and the Master Food Volunteers (MFVs) played a prominent role in VCE’s exhibit. Thanks to a team of energetic and creative MFVs—Katie Savarese, Holly Rowe, and Julia Schneider—we designed an interactive exhibit full of plenty of things to keep visitors busy. Volunteers chopped up honeylope melons donated by Twin Springs Fruit Farm and allowed visitors to sample them plain or dipped in coconut and lime juice. Visitors also got to make their own salt-free herb and spice mixes by making different combinations of basil, garlic powder, dill, cumin, and oregano. Fair visitors could also test their knowledge by playing the nutrition fact or fiction game, share their favorite food memories, enter a raffle for $25 gift cards, and pick up wallet-size cards with daily nutrition tips.

The lead MFV team was also joined by MFVs Nancy Broff, Kristin Bruce, Aleksandra Damsz, Dorothy Dempsey, Shari Henry, Marney Michalowski and Michal Warshow who put in shifts at the exhibit. Special thanks to our summer intern Carrie Vergel de Dios for creating many of the materials used in the display.

Residents at Carpenter’s Shelter Mix it Up in the Kitchen

Written by Katie Potestio, Master Food Volunteer

Last week participants in the Life Skills class at Carpenter’s Shelter, a homeless shelter in Old Town Alexandria, completed a three week healthy cooking series led by Master Food Volunteers Katie Potestio, Lise Metzger, Kristin Bruce, Desiree Morningstar, Nancy Broff, and Kim Frey. During the first class participants cooked a tasty Latin-style meal of black bean soup accompanied by cornbread and a corn and rice medley. The cooking was truly a team effort with contributions from very experienced cooks as well as novices in the class. In the second session the group whipped up some healthy whole grain breakfast items including banana-walnut oatmeal, applesauce French toast, and breakfast burritos (which included a special burrito-rolling tutorial!). Participants learned to be wary of the often empty “whole grain” claim on the front of food packages and to check the ingredient list on the food label for whole grain ingredients such as whole wheat.

The final session emphasized the longstanding healthy eating recommendation to eat more vegetables and some tips for how to eat a few extra during the day. The volunteers surprised participants with a creative way to fit more veggies in on a hot summer day – in smoothies! Using blenders donated by the community, participants created three delicious fruit smoothies including one green smoothie made with baby spinach. Blended in with fruit and sweetened yogurt the greens add an extra dose of nutrients and a fun color to this refreshing drink. The participants who dared to try the green smoothie agreed that it tasted good and said they would be likely to make it again. Other greens to try in the blender are chard, kale or bok choy. At the end of the night the volunteers surprised the class yet again by raffling off blenders that they had collected from community donations to eight lucky residents! Although making smoothies doesn’t require a recipe, below is the Green Smoothie recipe approved by the residents at Carpenter’s Shelter. Give it a try!

Green Smoothie Recipe

Servings: 4

2 large oranges, peeled and segmented

1 banana (frozen in slices if possible)

2 cups frozen strawberries

4 cups baby spinach leaves

2 cups vanilla low-fat yogurt

1 cup ice (if bananas are frozen, omit the ice cubes)

½-1 cup liquid such as water, juice or milk (optional)

Directions

In a blender, combine oranges, banana, strawberries, spinach, yogurt and ice. Puree until smooth. Add liquid as needed to help with blending. Serve immediately and enjoy!

Start Small But Start Now

By Mohna Shah, Master Financial Education Volunteer

We typically discuss resolutions in January because it signifies a new beginning to us. We fervently generate a list of several lofty and unspecific goals – save money, lose weight, quit smoking, start volunteering . . . and most of those ideas have perished before the end of the month.

While glancing through some back issues of a cooking magazine, I noticed that they started a Healthy Habits section so readers could focus on one change a month. Since it takes at least 18 days to change behavior, this approach seems much more sensible, even in the context of financial planning.

I can’t say I’ve incorporated the magazine’s recommendations for nutrition, but by applying it to my finances, I did experience an improvement in my health. I picked the beginning of the next month, which happened to be November 1st, and decided I would only eat out (dine-in, take-out, or delivery) three times a week. By selecting a frequency and not a dollar amount, I didn’t have to refrain from dessert or select a less interesting entrée at a fabulous restaurant.

But I did have to think about what going out to eat is worth if I’m going to use 1 of my 3 chances. Dashing out to pick up a mediocre sandwich during work or ordering cardboard pizza as a quick, no-thought dinner stopped immediately. I still celebrate birthdays and have a nice date night with my husband, but I appreciate the food much more.

When December rolled around, I decided to use only public transportation (train or bus) or my own two feet to get around the city that month. No cabs, no rental cars. Miracle of miracles, this Southern gal learned to enjoy walking through the city, taking in the architecture and holiday lights. And – without giving it much thought – I was still limiting myself to eating out 3 times a week. My motivation for these self-imposed directives had been to save money (each one’s value being at least $100 a month), but I was also eating better and walking more.

Almost a year later, these practices are still ingrained in me. There have been a few exceptions – renting a car to visit family and eating out four times in one weekend when my in-laws visited. But my overall habits have changed, and I don’t feel like I’m missing out. I’ve also had some success with non-financial goals — flossing more often, studying a foreign language — when focusing on one objective per month.

So don’t wait until January when it’s cold and dreary and you’re searching for inspiration. Pick this Monday or September 1st and make a small change. There are big rewards to be had.

Teaching and Learning

By Jackie Rivas, Master Financial Education Volunteer

VCE’s financial literacy classes offer opportunities not only to teach others about personal financial management, but also provide an opportunity to learn about techniques and cultures. I recently taught the financial literacy series at Virginia Gardens in Spanish to a group of Central American and Mexican immigrants. In one session we discussed the importance of reviewing your bank statements on a regular basis. A participant shared with the group how she was surprised to learn that she had insufficient funds in her checking account. She was sure she

had made sufficient deposits to cover her expenses. At the teller window she reviewed her statement and found that a magazine that she thought she had canceled had continued to withdraw funds from her account monthly over the past two years. She called the magazine right there at the window and although she normally has a hard time saying no made it very clear that her subscription had ended. We also talked about managing banking fees and charges. The participants compared the various costs of checking accounts, minimum balances, check-writing charges, late fees and fines. They were able to share their experiences regarding different banks and checking account plans and where to get the best deal.

But I also learned from my students. They taught me about a technique for saving money that is quite common in Central America, Mexico and among immigrants in the US who have limited access to the banking system, called the Tanda. One of my students explained how she has trouble saving money because she finds it difficult to resist the temptation to spend. But the Tanda works for her. She used it to save the $4,000 she needed to pay the hospital expenses for the birth of her child. She planned several months ahead of the delivery date. In the Tanda, a group of persons with a desire to save a specified amount of money agree to pool their money over a specific time period and each week someone from the group receives the pooled funds. For example, to obtain $4,000 a group of sixteen persons would contribute $250 weekly for sixteen weeks. Each week someone within the group receives $4,000. The payout order could be determined by drawing numbers from a hat or by the coordinator of the Tanda. Of course there are many dangers in this system. It requires a lot of trust among the participants. Someone could run off with their payout early in the game, never to be seen again. But that is where a sense of community works to discipline members. There also is no interest paid on the principal and no opportunity for the beauty of compounding interest. But for those who might find it difficult to obtain a loan from a bank, it is an alternative method for obtaining credit. Teaching the financial literacy classes not only provides a forum through which to help others learn how to better manage their money, but it also presents the opportunity to learn how other cultures meet the financial needs of their community.

Why Wait?

By Mohna Shah, Master Financial Education Volunteer

I love the number of websites and services devoted to getting women involved in personal finance. But I recently found myself at odds with an article on one such site that suggested people learn about investing in their 20s, ramp up their investments and contribute to retirement plans in their 30s, then increase the amount of retirement savings in their 40s, and so forth. That may work for people who live in areas with a low cost of living and who are not carrying much debt. But that’s a tough road to take in the metro DC area. I’ve watched many of my friends spend their 20s repaying their student loans while incurring credit card debt to keep up with the cost of living on entry-level salaries. By the time they have paid off their debt and are earning enough money to pocket some of it at the end of the month, they are in their early 30s and are just learning to create a habit of saving. Work and family consumes most people at that age, so learning about investing falls pretty low on the priority list.

For my friends who are in their 20s and 30s, I have recommended following all of those suggestions in order but ASAP, ideally in 5 years or less. Learn about financial planning now, whether it’s the Money Talk series through Virginia Cooperative Extension, a quick read of personal finance articles on eXtension.org, or a personal finance book. At this point, it’s an hour a week class or 15 minutes, 3 – 4 days a week during your lunch break or commute. At this rate, you’ll probably be able to generate some executable ideas for yourself in a month or two. Make small changes each month or each season to speed up debt repayments or increase savings. One of my friends was stunned to see how much money she saved by taking her lunch to work. (The weight loss was a nice by-product.) I had a similar reaction when I stopped taking cabs and relied only on the metro or my own feet for transportation. Neither of these actions had any noticeable impact on our social lives or overall happiness. As soon as that debt is paid, speak to a human resources representative about contributing to a retirement plan at work. Don’t worry if it’s $100 a month to start.* If your employer doesn’t offer a retirement plan, talk to a bank about opening up an IRA. Applying the small changes theory, increase the contribution by $50 each year. (After five years, you will have contributed $12,000 along with any investment gains or losses. ) The point is, saving a little now is a lot easier than catching up later.

For my friends who are in their 20s and 30s, I have recommended following all of those suggestions in order but ASAP, ideally in 5 years or less. Learn about financial planning now, whether it’s the Money Talk series through Virginia Cooperative Extension, a quick read of personal finance articles on eXtension.org, or a personal finance book. At this point, it’s an hour a week class or 15 minutes, 3 – 4 days a week during your lunch break or commute. At this rate, you’ll probably be able to generate some executable ideas for yourself in a month or two. Make small changes each month or each season to speed up debt repayments or increase savings. One of my friends was stunned to see how much money she saved by taking her lunch to work. (The weight loss was a nice by-product.) I had a similar reaction when I stopped taking cabs and relied only on the metro or my own feet for transportation. Neither of these actions had any noticeable impact on our social lives or overall happiness. As soon as that debt is paid, speak to a human resources representative about contributing to a retirement plan at work. Don’t worry if it’s $100 a month to start.* If your employer doesn’t offer a retirement plan, talk to a bank about opening up an IRA. Applying the small changes theory, increase the contribution by $50 each year. (After five years, you will have contributed $12,000 along with any investment gains or losses. ) The point is, saving a little now is a lot easier than catching up later.

Also, while we can’t rewind our own clocks, we have an obligation to prepare the next generation. The biggest influence on my financial behavior is probably having a savings account where I could save a percentage of my birthday/tooth fairy/report card money. I felt so grown up when I received the monthly statement, and I was giddy when my balance crossed the $100 mark. At a later age, I could save part of my weekly allowance (which I only received if I completed my assigned chores – talk about strict parents!). It helped instill the notion of saving as an end in itself, not a means to buying the next teen idol’s album.

The sum of birthday money and allowances and the money saved by choosing public transportation and brown bag lunches may not appear to make a significant dent in the cost of a college education. But the lessons of saving and thoughtful financial decision-making can be worth just as much.

*If possible, start with a contribution large enough to get the full employer match for a 401(k).

Thinking Outside the Box: Savings

By Joan C. Smith, Master Financial Education Volunteer

As a volunteer financial counselor with the Alexandria/Arlington, we have many opportunities to serve the residents of Arlington County and Alexandria city. I recently had the privilege to speak to a group of residents of an apartment complex in Arlington. We taught on the subject “Pay Yourself First” as part of a Money Management series under the FDIC’s Money Smart program.

We were discussing a section about goal-setting and various ways to save. Aside from many common ways to save: i.e.: payroll deduction, opening a savings account, etc., one participant gave an interesting suggestion that I had never heard of.

Many have heard of and some of us already practice the idea of putting loose change in a container/jar and allowing it to build up and once it builds, one can use coin holders to place coins in and take those to their local banker or use a (free) coin counter machine. This participant had a totally “non traditional” method that worked for her. What this participant did (and continues to do) is she had a goal of saving up for a vacation for her family. She placed several (not one) jars in various places in the apartment. She wanted her kids to be an active part of this savings endeavor.

Many have heard of and some of us already practice the idea of putting loose change in a container/jar and allowing it to build up and once it builds, one can use coin holders to place coins in and take those to their local banker or use a (free) coin counter machine. This participant had a totally “non traditional” method that worked for her. What this participant did (and continues to do) is she had a goal of saving up for a vacation for her family. She placed several (not one) jars in various places in the apartment. She wanted her kids to be an active part of this savings endeavor.

She started one year out. By the time the year rolled around; between several jars of “loose change,” she had saved about $500 in one year!

Unfortunately, her husband fell ill and the monies saved had to be used towards his medical bills.

I commended her nevertheless because:

1) A goal was set

2) Even though she had to use it for an emergency and forfeit a family vacation, at least she didn’t go into further debt when her spouse fell ill.

3) The fact that she even had the funds for this unfortunate emergency saved her possible hundreds if not thousands in collection bills, late charges, and possible ruined credit.

What about you? Are you saving your “loose” change? Can you clean out an extra peanut butter (or almond butter) jar and use it in addition to the jar you may already have?

If this isn’t thinking outside the box to save, then what is?

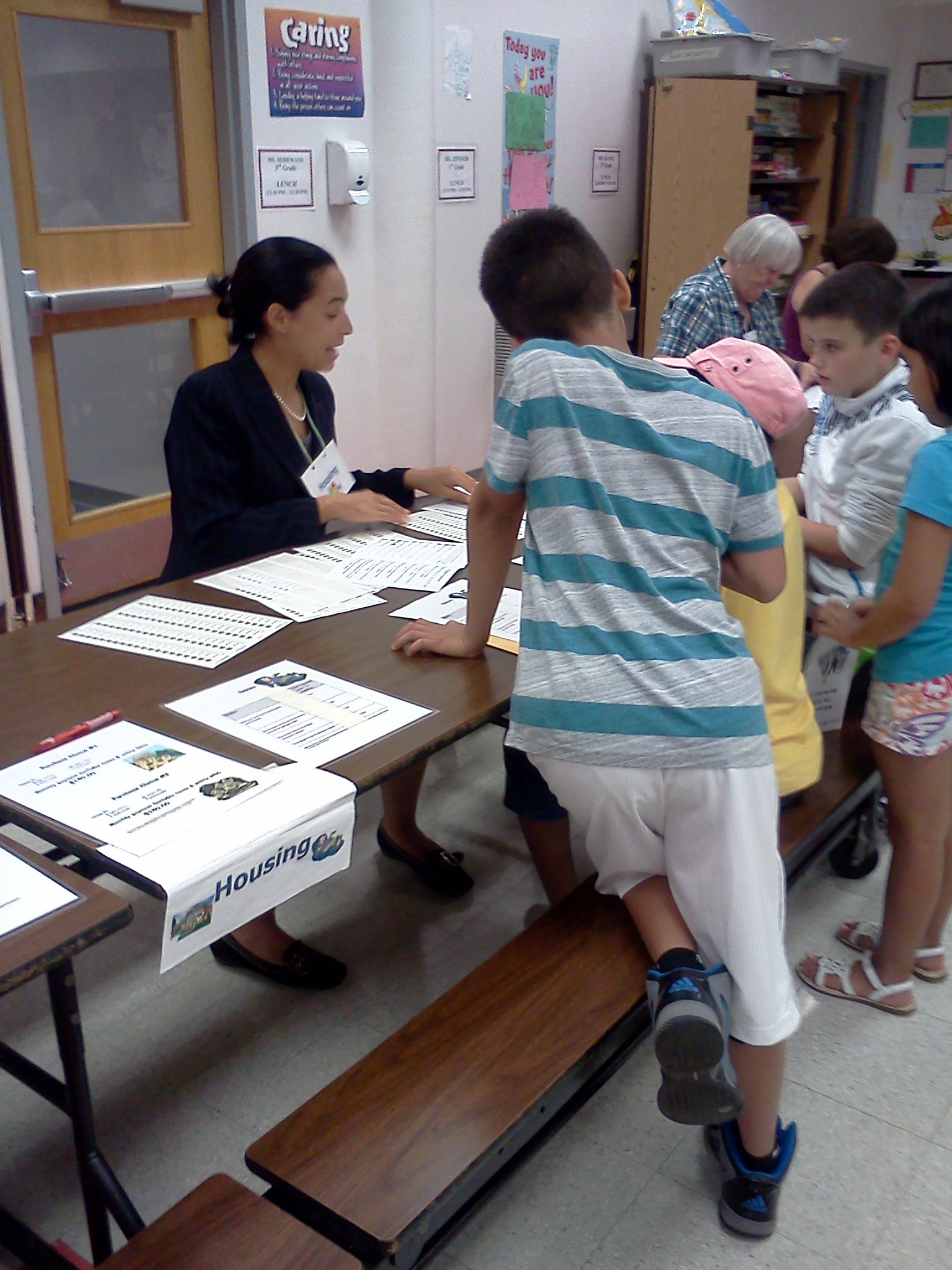

Kids Learn About Spending Money at Kids Marketplace

Last Monday we ran a Kids Marketplace simulation with 23 kids attending a summer program at Arlington’s Patrick Henry Elementary School.  The kids enjoyed chatting with each station’s volunteers, who either coaxed them into spending wisely or into buying more than they needed.

The kids enjoyed chatting with each station’s volunteers, who either coaxed them into spending wisely or into buying more than they needed.  Some kids found they could afford multiple pets, while others shared housing to reduce expenses. One kid saved nearly 50% of his doctor’s salary.

Some kids found they could afford multiple pets, while others shared housing to reduce expenses. One kid saved nearly 50% of his doctor’s salary.

For more pictures, visit our Facebook site: https://www.facebook.com/VceFinancialEducationProgramArlingtonCounty

If you would like to organize a Kids Marketplace at your elementary school, please contact Jennifer Abel at jabel@vt.edu or 703-228-6417.

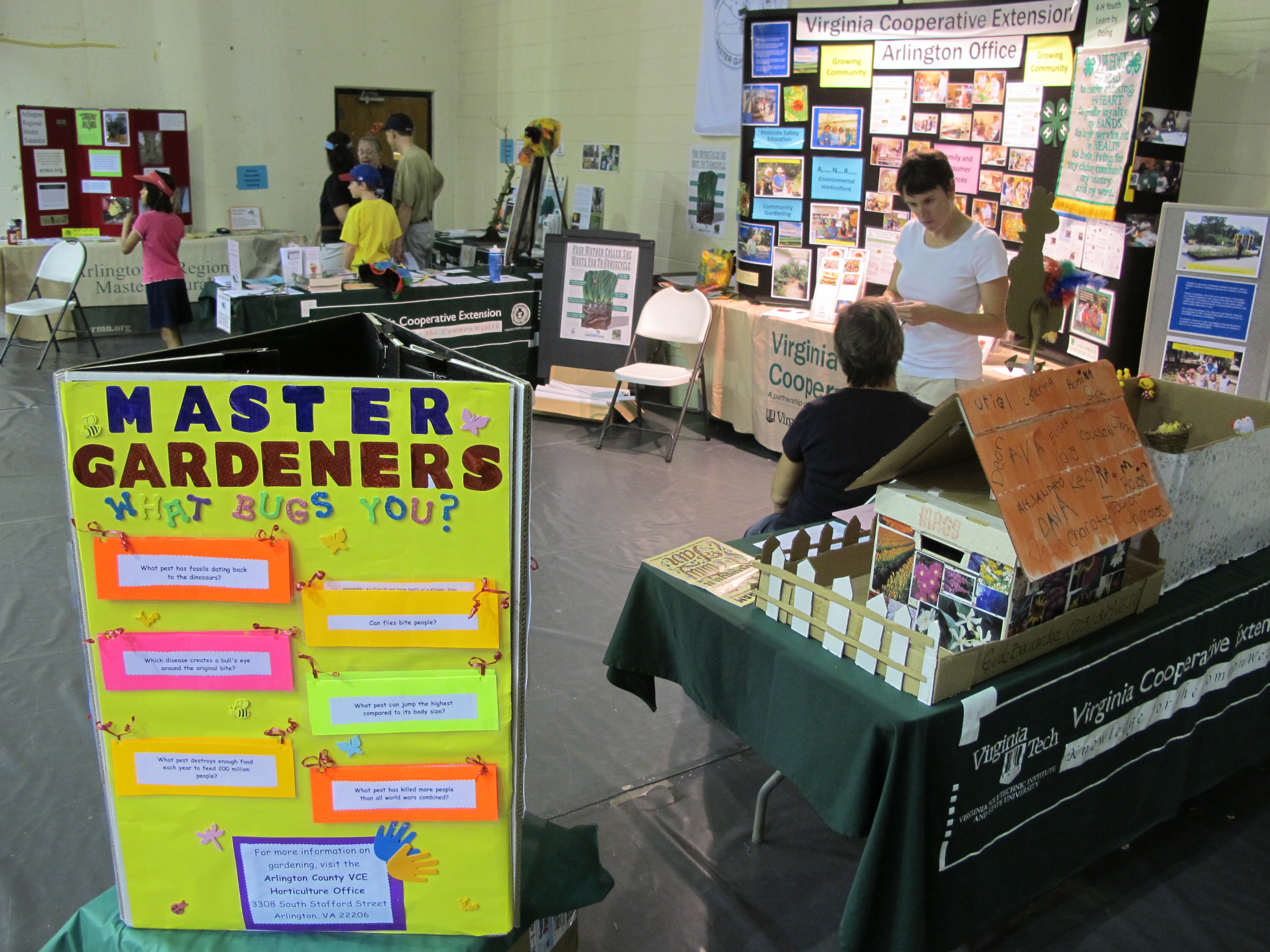

Master Gardeners Put on Arlington County Fair Competitive Flower and Vegetable Shows

Every year Arlington County gardeners celebrate the diversity of their gardens by sharing the fruits of their labors with the public. Both the competitive Flower and Flower Arrangements and  the Vegetable Fruits and Nuts Competitive Exhibits at the Arlington County Fair are supported by VCE Master Gardeners who serve as superintendents, judges, and administrative volunteers. This year, Extension volunteers will preside over two shows that take in entries from hundreds of exhibitors vying for blue ribbons and maybe even a Reserve or Grand Champion awards. Last year’s show inspired this entry from Nabih S. whose pumpkin was a huge hit. How big was it? Well it took two people to pick it up and the small tomato in the lower left corner will give an idea of its size.

the Vegetable Fruits and Nuts Competitive Exhibits at the Arlington County Fair are supported by VCE Master Gardeners who serve as superintendents, judges, and administrative volunteers. This year, Extension volunteers will preside over two shows that take in entries from hundreds of exhibitors vying for blue ribbons and maybe even a Reserve or Grand Champion awards. Last year’s show inspired this entry from Nabih S. whose pumpkin was a huge hit. How big was it? Well it took two people to pick it up and the small tomato in the lower left corner will give an idea of its size.  Look again here for postings of this year’s winners and be sure to visit Virginia Cooperative Extension’s fair booth at L-10-11-12 and see our many interactive displays that include a Master Gardeners Plant Clinic, Master Naturalists (and you might get to visit with a snake!), Master Food Volunteers will demonstrate herbs and spices, and our 4-H program will be showing off chicks and embryology science.

Look again here for postings of this year’s winners and be sure to visit Virginia Cooperative Extension’s fair booth at L-10-11-12 and see our many interactive displays that include a Master Gardeners Plant Clinic, Master Naturalists (and you might get to visit with a snake!), Master Food Volunteers will demonstrate herbs and spices, and our 4-H program will be showing off chicks and embryology science.

See you at the Arlington County Fair at Thomas Jefferson Community Center Thomas Jefferson Community Center 3501 Second Street South Arlington, VA 22204. Fair hours and parking details are here: http://arlingtoncountyfair.us/